Stock Market School for US

In Just 2 Hours a Month for 1 Year — You Can Learn the Stock Market

This program is a structured Education System for Women who want to make smarter money moves, build financial confidence, and become real investors.

You Deserve to Build Wealth Without Guessing

Join the class that makes Investing Clear, makes You Confident, and is Designed for Us

***Free Live Webinar “Stock Market Strategies” February 17th at 7pm CST***

Click the Button below to Save Your Seat!

STOCK MARKET SCHOOL for US INVESTING CLUB

In addition to our Free Webinar “Stock Market Strategies”, we have a Paid Program called “Stock Market School for US Investing Club”. This 1 year program starts with a 1.5 hour Live Intake Class that is followed by 22 Live Classes over the next 11 months held every 2nd and 4th Sunday of the month at 7pm CST.

NEXT INTAKE CLASS FOR THE PROGRAM:

MARCH 3rd 2026

Next Live- STOCK MARKET SCHOOL FOR US INVESTING CLUB- ORIENTATION CLASS -For - Stock Market School For US is: Tuesday March 3rd at 7:00pm (CST) - 1.5- Hour Training- ENROLL In Your Program Today

⋆

Next Live- STOCK MARKET SCHOOL FOR US INVESTING CLUB- ORIENTATION CLASS -For - Stock Market School For US is: Tuesday March 3rd at 7:00pm (CST) - 1.5- Hour Training- ENROLL In Your Program Today ⋆

Problems You Are Facing Right Now

Feeling Frustrated & Exhausted – You work hard but feel like you are never getting ahead.

Stuck – You feel behind, like you “should know more,” but never had access to the right knowledge. You don’t know where to start.

Trapped – You realize you have been set up to fail but you don’t know how to break free.

Hopeless – You think about retirement, emergencies, or never being able to enjoy life without financial stress.

Know This….

A planned Financial Oppression System is at play.

There is a rigged structure designed to keep people in debt, financially uneducated, and trapped in a cycle of survival instead of wealth-building.

This system includes:

High-interest debt & predatory lending that keep you working harder just to stay afloat.

A lack of financial education that prevents you from learning how to escape the cycle.

Gatekeepers who profit from confusion—banks, credit card companies, and institutions that thrive when you don’t know how to leverage money.

The system keeps you:

Drowning in debt with no clear way out.

Living paycheck to paycheck, no matter how hard they work.

Confused & intimidated by wealth-building, making you feel like investing and financial growth isn’t for you.

Feeling frustrated, stuck, and maybe even ashamed—like you should know more by now, but no one ever taught you.

Dependent on jobs & loans, never truly in control of your financial future.

This isn’t an accident—it’s by design. The system even has you believing that struggling financially is normal, while the wealthy keep getting richer off your lack of financial literacy.

Right is Right and Wrong is Wrong…

It shouldn’t be this way. Hardworking people ought to have access to wealth-building knowledge, yet the system profits from your financial struggle.

The Escape Plan:

I created a Program for people like “us”.

The “first-timers”, the “I-don’t-know-where-to-start” crew, and the folks tired of doing everything “right” and still feeling behind.

You don’t have to stay stuck.

The System Wasn’t Built for You to Win—But That Ends Today.

This course isn’t just about teaching money- It’s about giving you a voice in a larger fight.

It’s about showing you that your personal struggle is part of something bigger- a battle against a broken system that is designed to keep you small.

When you decide to enroll in this course, you are choosing a side in a bigger fight.

You are saying:

“I will not be a financial pawn.”

“I will not let my family struggle for another generation”

“I will take my seat at the table and claim the wealth I deserve”

People are not taught Money in school because Ignorance keeps them Controlled.

You shouldn’t have to figure out wealth building on your own, while banks, credit card companies, and corporations profit off your lack of knowledge.

Education is the Weapon that dismantles the system.

The difference between those who stay stuck and those who build wealth isn’t luck—it’s Knowledge, Strategy, and Action.

The Stock Market School For Us Program is your weapon against the system. It gives you:

A step-by-step strategy to eliminate debt, raise your credit, and start investing.

Confidence & clarity so you stop feeling lost and start making empowered financial decisions.

A roadmap to financial freedom so you can break the paycheck-to-paycheck cycle and build wealth for generations.

What is Included?

This program was Built to make financial literacy simple, clear, and empowering.

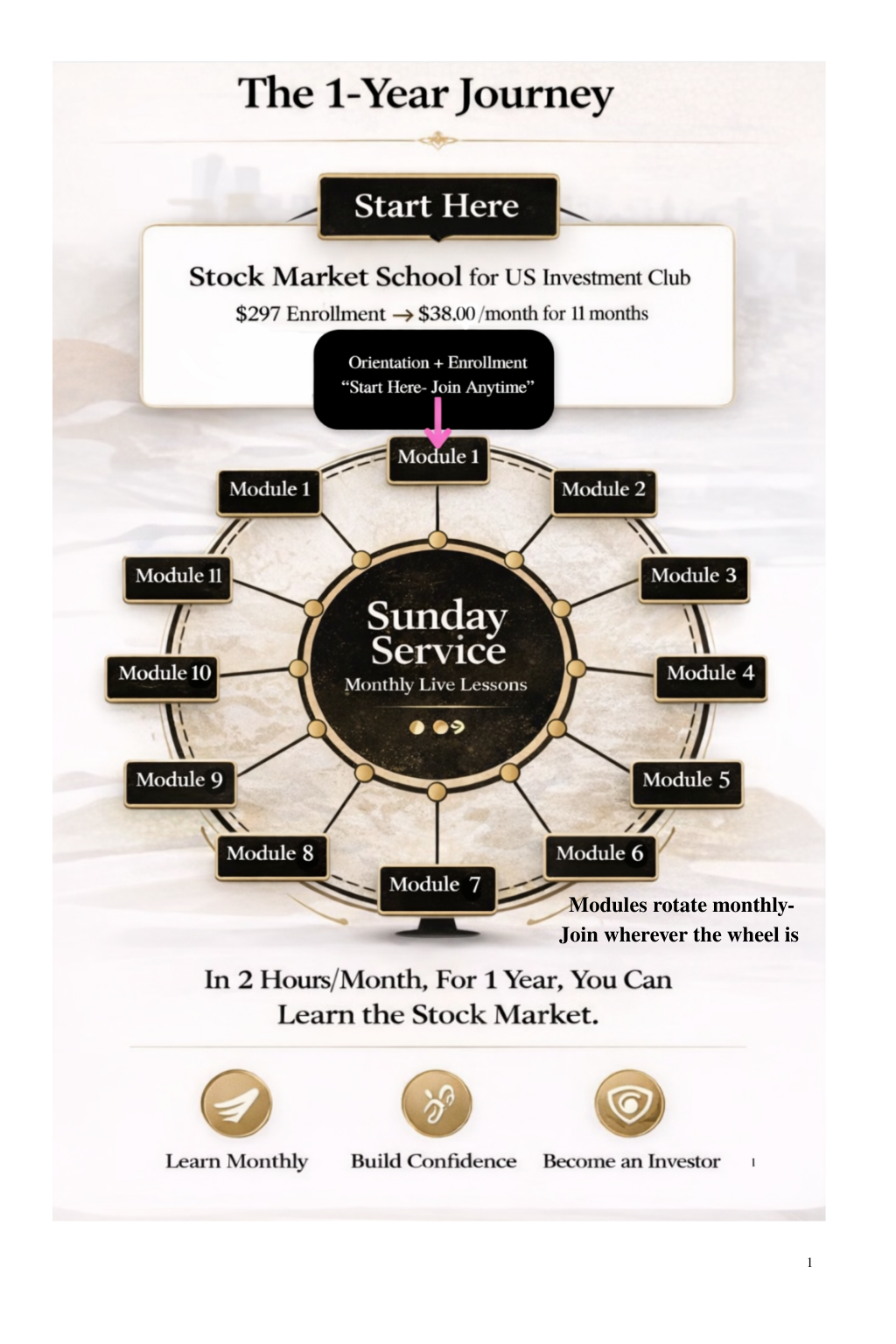

Your 1 Year Journey

Start with your Day 1 Course. A Live 1.5 Hr. Enrollment Orientation Webinar. ———————————————————

After Orientation, you will be automatically enrolled in “Sunday Service”. This is a live workshop class that happens Twice a Month. We call it Sunday Service as a reminder that It’s every (2nd and 4th Sunday) of the Month for 1 Hour. We meet at 7pm CST both days. In this program you will:

Research the Stock of several companies and perform stock analysis on each of them.

Examine past stock performance on several companies and compare it to their current performance to identify trends and patterns

Examine 10K Reports from several companies, locate their quarterly Earnings calls are, and examine their existing performance in the marketplace.

If Stocks rise or fall, we will look at drivers that caused the change

Discuss what to do when a stock falls

Build business acumen

Explore Book Club (Discussions)

Examine 401(K) Education

Examine Taxable Brokerage Accounts (Used to Purchase Stock),

Traditional IRA , and Roth IRAs

Evaluate a stock and what to look for

Analyze different companies and their stock each month as learning examples

Perform continuous Stock Tracking as a class activity monthly

Explore High Yield Savings Accounts, CD’s, Money Market Accounts, and when they are smart to use.

Examine Compound Interest and exactly how people make money in the Stock Market.

Calculate the math and numbers on how to use the stock market to replace your income. You will learn the math. (It’s very easy)

Examine Lease Payments and How they are determined (They use a Money Factor not Interest Rate)

Analyze Leasing a vehicle verses Financing a Vehicle. Look at how dealerships take advantage.

Examine Insurance and how it works

Examine mortgage loans and how they are calculated

Discuss Escrow Accounts and How to Prevent Mortgage Shortages

Uncover how Investors use Inflation to make money

Examine Strategies that Increase your Cash Flow w/ Step-by-step guidance

Work with a Financially Programmed AI (Artificial Intelligence)

The Yearly Total is $715.00

Your Enrollment Fee is $297 to start. This enrolls you in a monthly subscription of $38.00 a month for the next 11 months.

Stock Market For Us Investing Club

$297.00 to Enroll, then 11 payments of $38.00/ month **LIVE** Zoom Classes.

March 3rd 2026

7:00pm (CST)

News You Can Use—

We ran The Data on the Average Adult and Investing…

Still think you’re alone? The numbers say otherwise…

61% of Americans are living paycheck to paycheck — even people earning six figures.

(LendingClub Report, 2023)

Only 1 in 3 adults feels confident making investing decisions.

(FINRA National Financial Capability Study)

The average household is paying $1,000+ a year in credit card interest, while the stock market returned 10% annually over the last decade.

(NerdWallet + S&P 500 Historical Data).

Imagine the version of you that shows up different.

Money gives her choices, options, flexibility, and control over her time.

The moment you decide to move differently, everything starts to change!

Next Class Starts:

March 3rd 2026

7:00pm (CST)